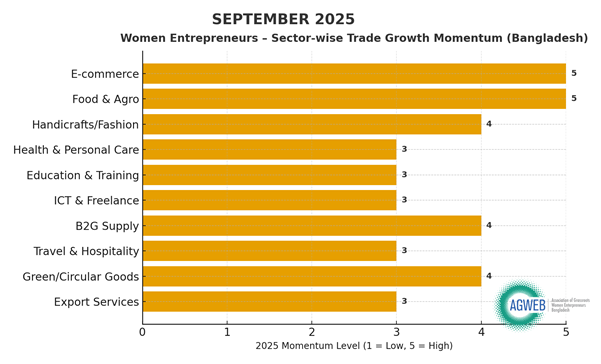

As Bangladesh steps into October 2025, the echoes of September’s trade winds linger in the air. Across bustling marketplaces, glowing smartphone screens, agro sheds, and handcrafted boutiques, women entrepreneurs continue to rewrite their chapters in the country’s economic story. September was not just another month on the calendar — it was a mirror reflecting sectoral shifts, digital awakenings, and the stubborn realities women business leaders navigate daily.

This blog dives deep into sector-wise trade growth trends of women-led businesses up to September 2025, and charts strategic implications for Q4. Every insight here is grounded in actual signals — no inflated numbers, no hollow hype.

E-Commerce & Online Retail

Women-led boutiques, beauty brands, home décor sellers, and kidswear shops continue to thrive through Facebook pages, online marketplaces, and direct WhatsApp commerce.

- Momentum: High

- Drivers: Low entry barriers, smartphone adoption, digital skills programs.

- Friction: High data costs, platform harassment, safety issues.

E-commerce remains the fast lane for women entrepreneurs — but the road is bumpy. Those who combine strong branding with verified marketplace presence are seeing consistent monthly growth.

Food & Agro-Processing

From aromatic spice blends to safe & organic snacks, women-owned MSMEs are shaping Bangladesh’s culinary economy. Urban consumers’ demand for safe, home-style foods has skyrocketed.

- Momentum: High

- Drivers: Urban demand, social commerce logistics, proven business models.

For many women, this sector is the on-ramp to formal trade. The logistics ecosystem is increasingly supporting doorstep delivery, enabling small producers to reach national markets.

Handicrafts, Fashion & Light Manufacturing

Boutique tailoring, embroidery, jute and leather crafts have shifted from local fairs to niche export and digital storefronts.

- Momentum: Moderate → High

- Drivers: Strong domestic demand, emerging export niches.

- Gaps: Market access, formalization, export readiness.

Women-led enterprises in this sector have cultural capital on their side — the next leap depends on better branding, export documentation, and formal business setup.

Health & Personal Care Services

Women-led clinics, diagnostics, wellness centers, and cosmetics ventures are serving Bangladesh’s growing urban middle class.

- Momentum: Moderate

- Challenges: Regulatory compliance and capital access.

This sector holds immense potential but remains limited by financing gaps and compliance hurdles that keep many initiatives small and informal.

Education, Training & Care Services

From coaching centers to daycare facilities, women entrepreneurs are addressing steady community demand.

- Momentum: Moderate

- Advantages: Low capital expenditure.

- Limits: Informality constrains scalability.

While this sector isn’t headline-grabbing, it provides reliable livelihood streams, particularly in peri-urban and small-town areas.

ICT & Freelance Services

Women are increasingly stepping into digital service roles — social media management, virtual assistance, design, content, and micro-SaaS offerings.

- Momentum: Moderate

- Opportunities: Global freelance platforms, rising digital literacy.

- Constraints: Gender gaps in connectivity, safety concerns online.

This is a sector with a quiet but significant wave, and with safer digital spaces and skill-building, it could surge.

Procurement-linked B2G Supply

Women-led firms are starting to tap into government procurement for stationery, uniforms, catering, and simple equipment.

- Momentum: Emerging (Up)

- Driver: Sustainable Public Procurement policy, which favors women-led bidders.

- Needs: Vendor readiness — TIN, VAT/BIN, product specs, bank letters, past POs.

This is a sleeping giant sector. The opportunity is real — but so is the paperwork. Strategic capacity building will decide who benefits.

Travel, Events & Hospitality

Boutique homestays, event catering, and décor businesses are slowly rebounding.

- Momentum: Moderate (volatile)

- Drivers: Post-pandemic recovery, city events.

- Risk: Dependence on discretionary spending.

Women-led firms here are agile and creative, but the market remains unpredictable. Flexibility is key going into Q4.

Green, Reusable & Circular Goods

From eco-menstrual products to upcycled crafts, women are leading Bangladesh’s small but growing sustainability niches.

- Momentum: Emerging (Up)

- Drivers: Global and local retail tilt toward sustainable goods.

While niche, this sector is gaining traction — particularly among urban youth and export buyers seeking low-waste alternatives.

Export-adjacent Logistics & Trade Services

Women entrepreneurs are increasingly participating in small export orders via aggregators, especially as Bangladesh’s port infrastructure upgrades.

- Momentum: Emerging

- Drivers: Bay Terminal upgrades, trade facilitation.

- Challenges: Scale, compliance, documentation.

The infrastructure tailwinds are real. Once compliance support improves, more women will step into export logistics confidently.

Five Reality Checks

- Digital is the women’s growth lane — with speed bumps.

Smartphone + training interventions consistently boost sales. But data costs and harassment continue to choke the scale. - Policy tailwinds exist — finally.

Sustainable Public Procurement is opening B2G demand to women-owned firms. The key is being vendor-ready. - Finance narratives are shifting.

Targeted SME finance products are emerging, but collateral and formalization barriers persist. - Macro labour trends are mixed.

Female participation in formal employment remains low, making entrepreneurship a practical pathway. - Trade infrastructure matters.

Bay Terminal & logistics upgrades are lowering costs and cycle times — a game-changer for small exporters.

Strategic Implications for Q4 2025

As we move through October and into the final quarter of the year, the signals are clear:

- Double down on high-momentum sectors like e-commerce, food & agro-processing, and handicrafts/fashion.

- Build formalization muscles — proper documentation, branding, and financial records.

- Tap into B2G procurement with strong vendor profiles.

- Strengthen digital safety and literacy, particularly for solo women founders.

- Align with infrastructure improvements to explore small-scale export opportunities.

October is not the time to coast — it’s the moment to steer deliberately into 2026.

Closing Reflection

The story of women entrepreneurs in Bangladesh is not a trend — it’s a transformation. It’s happening in kitchens and co-working spaces, in rural homes and urban rooftops, in quiet determination and public marketplaces.

As October unfolds, these women are not just riding the trade winds — they are charting the currents, one small enterprise at a time.